The Key Benefits of Implementing a Data Warehouse

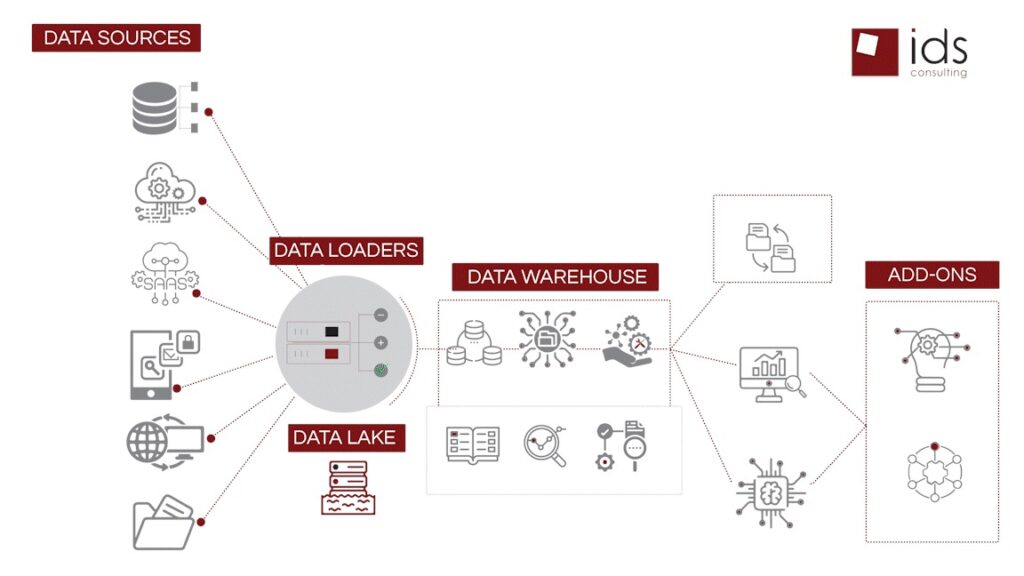

In today’s data-driven world, banks are facing increased pressure to provide faster, more personalized, and more efficient services to their customers. To meet these challenges, banks must be able to access, analyze, and utilize vast amounts of data quickly and effectively. This is where data warehousing comes into play.

Data warehousing is a comprehensive solution that enables banks to integrate and manage all of their data in one central location. This allows for easier and faster data access, analysis, and reporting, which leads to better decision-making and improved performance. In this article, we will explore the key benefits of implementing a data warehouse for your bank.

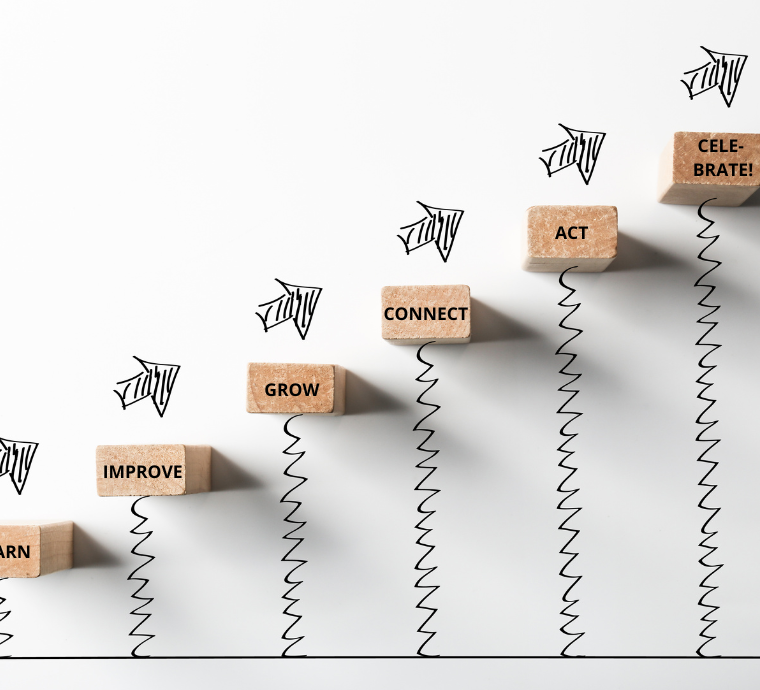

1. Improved Data Management

Banks generate and store vast amounts of data every day, and this data is often scattered across multiple systems and databases. A data warehouse consolidates all of this data into a single repository, making it easier to manage, access, and analyze. This means that banks can get a complete view of their customer data, transactions, and business operations, which is critical for effective decision-making.

2. Enhanced Data Analysis and Reporting

Data warehousing also enables banks to perform advanced analytics and reporting on their data. By integrating data from multiple sources, banks can gain insights into customer behavior, preferences, and trends, as well as operational efficiency, risk management, and compliance. This allows banks to identify areas for improvement and make data-driven decisions that can drive growth and profitability.

3. Faster Time to Market

In today’s fast-paced business environment, banks need to be able to respond quickly to market changes and customer needs. A data warehouse allows banks to access and analyze data faster, which can lead to faster decision-making and product development. This means that banks can bring new products and services to market more quickly, which can give them a competitive advantage.

4. Improved Customer Service

One of the biggest benefits of data warehousing for banks is improved customer service. By integrating customer data from multiple sources, banks can get a 360-degree view of their customers and their needs. This allows banks to personalize their services, offer targeted marketing campaigns, and provide more efficient and effective customer support.

5. Compliance and Risk Management

Banks operate in a heavily regulated industry, and compliance and risk management are critical to their success. A data warehouse can help banks meet regulatory requirements by providing a complete view of their data, which can help with reporting and auditing. It can also help banks identify and manage risks, such as fraud, by providing real-time insights into transactions and customer behavior.

In conclusion, data warehousing is a powerful solution that can help banks improve their performance, meet customer needs, and stay competitive in today’s fast-paced business environment. By consolidating data into a single repository, banks can gain a complete view of their data, perform advanced analytics and reporting, and improve their decision-making. If you’re a bank looking to boost your performance and profitability, consider implementing a data warehouse today.