Overview

The Romanian Banking System has undergone serious digital transformation in the past years, especially following the 2020 COVID-19 crisis, with full remote work backing and digital products offering. This is a long going process that the Banking System has been lacking in the digital era with products that offer digital alternatives such as Revolut™ (the main banking alternative at this time in Romania) sky rocketing in the past years with exponential user adoption over the entire system on a younger and more digital segment.

Although many executives and managers undermined its influence due to second hand banking options and no fully fledged adoption the scenario now fades away and the cold realization is felt more and more. Clients adopt the payment system for day to day transactions and abroad usage while the Romanian banking system is trying to minimize the impact by improving their products and offering low rates on foreign payments and zero commissions on their ATM cash withdrawal. The process is complex and slow, but with small victories here and there due to change in digital alternatives increasing their commissions as they try to stay afloat.

How can the banks understand their portfolio if the employees that actually engage with the customer, do not?

Need for changes?

This scenario has led to more and more executives to understand the need to change their data usage and adopt a more data driven approach when engaging with their portfolio through commercial campaigns. This represents a big leap of faith considering that business know-how was the go-to for most of the campaigns and interactions with the client. While this is a great opportunity for growth, the banks are having setbacks due to lack of investment in their analytics infrastructure over the years and digital capabilities. The rise of the digital era comes with high costs for those who denied the need for change and significant impact for those who oversee it but did not prioritize it.

Following the critical changes that arrived with 2020, the banks turned attention to better understand their portfolios and scouted talents among the Analytics and Machine Learning community in the hope that they could provide a suitable set of products and services for their clients without disrupting the in place legacy approach and systems. This raises several problems and questions. Can Analytics provide insights using out of date systems? Can the banks follow the same approach as in the past, but increase their profit margins without investing in new technologies just by solely adding more human resources? No and no. While the shift in upper executive mentality is the right move, the banks lack the knowledge and analytics infrastructure to do so. The expectation is that with years and years of data there is no need for system upgrade, but just a few more human resources in place and a desire to adopt those practices will do the trick.

What’s to be done?

Studies show that the client’s desire is to interact with their bank as a partner rather than a service provider. That being said, there is an ongoing race between banks in order to provide their customer officers with insights and specific offerings for certain segments by upgrading their CRM solutions with in-house developments or referring to 3rd party solutions. This is a big move and certainly a game changer, but it is not enough for today’s standards.

Arguably the mindset is good, but the approach lacks in critical instances. For example, how can the banks understand their portfolio if the employees that actually engage with the customer, do not? How can the customer officers provide suitable products, information and resources for the client if there is no in-depth understanding on why certain products are suitable for a client and why some are not? Those questions go back to a lack of end-to-end usable and suitable Analytics infrastructure that suits the vision and journey the organization envisioned.

One hot potato that the Banks seem to not fully grasp is how to integrate and truly leverage the power of a Big Data infrastructure – mainly Hadoop based. Multi-million infrastructures were secured usually via Bank Group level offerings and implementations. This clearly represents an advantage, but the issue is that those solutions see little real usage and no clear advantage in securing key customer insights. Minimal usage and a lack of upgrades have raised questions among executives if this is the correct move or it was just a phase for the Banking system and the change was not worth the money invested thus far.

Can banks keep up with the speed of technology development?

After a partial failure of understanding why the solutions in place are failing, the attention has shifted to Cloud based solutions and providers. More and more banks are viewing cloud infrastructure as the holy grail of customer interactions and basically the new scapegoat of why their approach lacks substantial results. Cloud providers are lobbying board members and infrastructure leaders into buying solutions that could scale up their analytics efforts and provide possible significant returns over the years. This is not really the case. We do not consider that an analytics cloud infrastructure is a bad move, but we consider that it is not the answer to why most solutions are not as efficient as desired. The term Data Lake is stretched and overly used among managers that consider it the new money-making machine and an alternative for the traditional Data Warehouses. Well, it is not and it will never be. No Romanian bank is currently leveraging the full power of a Data Lake to obtain otherwise invisible insights, but the direction is good.

The problem is that technology moves faster than banks can adopt and implement, thus some of them are still using out of date Big Data Systems (e.g. Hadoop) with barely maintained versions for their software solutions and components, making it obsolete in terms of real usage for the current market. Of course they can offer some interesting insights through the power of distributed computing over data such as Mobile Banking applications logs, Bank website logs and so on, but that is where the show stops and use cases become obsolete due to significant small datasets. The system basically goes down as a stage “schema” or just a storage unit for whatever data the Database team does not want to store inside the Data Warehouse.

As a general view of the Romanian Banking system we tend to say that “they do not see the forest because of the trees”. Most managers search for a scapegoat. This is why some of them have several BI Reporting Tools or systems – because you always search for that one tool that can save you, even if you end up with several serving the same purpose. What Banks need is to change the focus from fast out of the blue unreasonable expected results – with minimal effort – and that search for the beat-them-all Holy Grail solution to a more practical approach and small suitable infrastructure that serves the given purpose.

The ideal scenario in the Banking industry

The analytics spectrum should contain a suite of solutions, each interconnected, that serve a common purpose (whatever that purpose is – but usually comes down to profits). There should be an open connection and communication within the analytics stack and between all other needed systems to ensure that whatever valuable insights are processed and retrieved, they will be correlated with many other aspects of the business (e.g. segments, needs, journeys, campaigns and many more). A light ready-to-use system is usually the better option to weigh in rather than investing millions in heavy infrastructure that might or might not start to pay itself.

Open Source on premise solutions enhanced for the organizational need via extensions, plugins or in house developments are viable and suitable alternatives in the analytics space rather than heavy load proprietary infrastructure and solutions. The alternative boosts both infrastructure capabilities and company know-how by enhancing already business infused knowledge departments with new out of the box approaches and techniques from the open-source community. Banks should follow the road that the IT sector took and invest in new R&D departments and teams that not only focus on existing system approaches, but investigate new leads and ways of enhancing the customer experience. Those teams should be developed to focus not only in terms of infrastructure innovation and employee know-how, but also in terms of customer satisfaction and interaction with the bank.

Instead of conclusions

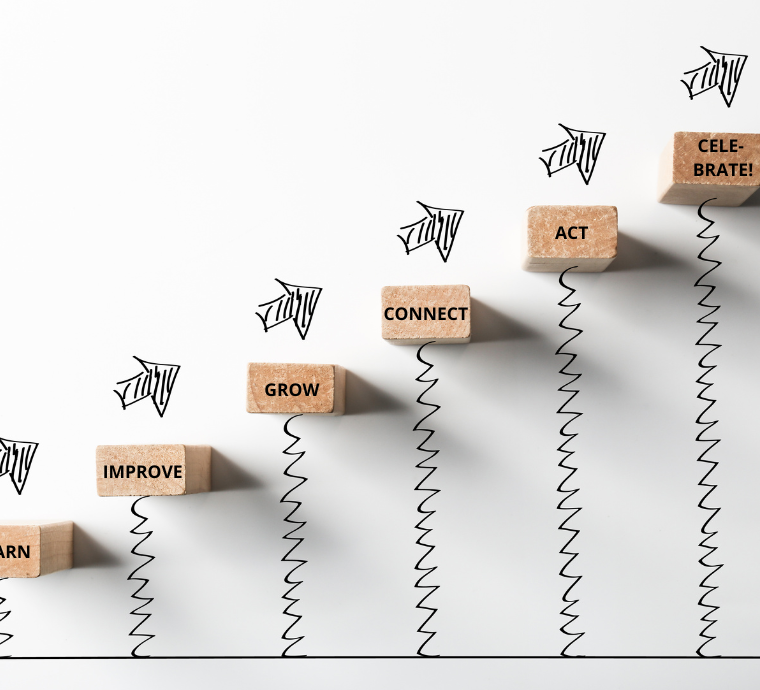

Lately there is a movement of change in terms of day-to-day activity by migrating from the classical waterfall to a more agile way of work. Concepts are quickly being adopted not only by the technical departments, but also by the business side. There are still several milestones to be met to fully adopt it, primarily not to blend the two ways, which basically translates into a waterfall with sprints.

We do see powerful waves of change in the industry, with a principal focus in the digital adoption, and there is much more to be done. As all new things there is a learning curve that needs to be addressed first and we are at the mere beginning of it. Banks will fully grasp the adoption of the analytics ecosystems in the same way they adopted the new Data Warehouses. By failing to scale big then iteratively get it right step by step. The same with the Analytics/ ML and maybe (but probably not) Deep Learning systems. They need to fail first and get it right bit by bit to fully grasp and understand what their data can uncover for them.